EIC Accelerator and 6 things YOU need to win funding

← Back to press releases.jpg)

Invent Baltics has helped 35+ startups raise >€60 million equity free bridge funding since 2014. Our supported startups have gone to raise €170 million more. So, we might know a thing or two about what it takes to raise funds for deeptech through the EIC Accelerator.

We in Invent Baltics brainstormed what it really takes to become an EIC Accelerator Champion. We have been helping startups to raise funds and fulfil their ambitions since 2015 through the EIC Accelerator (previously SME Instrument).

To date we have helped 35 startups to raise >€60M in non-dilutive (up to €2.5M) bridge funding. They have gone to raise €170M more.

So, we might know a thing or two… or more specifically…

We found 6 key things to consider when raising funds!

Why you do what you do?

“Ideas are a dime a dozen. People who implement them are priceless”

(Mary Kay Ash, best-seller & founder)

The world is full of incredible ideas, many of them never go anywhere. This is because great ideas without a unique, passionate and strong team behind them, fall flat when things get tough.

VCs & other investors know this intimately… When investing early, you invest predominantly in the team and their promise & ability to change the world. We in Invent Baltics see this nearly every day.

Thus, if the founding team does not have an intimate bond between each other & the problem they are solving, something is missing on that cold harsh night on your 3rd year of building your company.

We find that founders, who have a story on why they got together to tackle a problem work best in the long-run.

It can be a collaborative story and understanding what it is like fighting depression, because they themselves or their loved ones were affected by the 40kg weight on their mental shoulders.

It can be the desire to wear different clothes every day without worrying about the pollution caused by textile waste of those clothes.

Whatever the story is, it is key that it matters deeply to you, your extended team and to your network.

As, when you have that story and the connection, you can explain to everyone at any time, why you do what you do! This allows you to work effectively to change the world. Because, remember:

“Great things in business are never done by one person. They’re done by a team of people. “

(Steve Jobs, Apple)

Market disruption comes from solving existing problems, so…

Solve a real pain with a proper painkiller!

(Any investor ever)

I am sure that most of us have heard the vitamin vs painkiller comparison. A vitamin is designed to make something a bit better, a painkiller is designed to solve a real pain.

While a vitamin can make you a success, a painkiller will change the world. And remember, you do not start a company because you want to be an entrepreneur for the fame and glory that might follow it. You become an entrepreneur to solve a real problem!

With EIC Accelerator funding available for disruptive EU startups & SMEs it is about looking for ways to eliminate real pains that plague the world. Thus, it is not enough that your company has a large market opportunity, it needs to make a difference!

This is exactly what private investors are moving towards as well with their investment doctrines moving more towards impact investment, whether it is sustainability, helping people live or laying the technical foundation for the future.

These painkillers can eliminate a problem that we have been forced to accept through necessity.

For example, we in the world regard treating bone voids by using the patient’s own bone as the “Gold Standard”. But doesn’t sourcing a suitable bone from another part of the patient’s body lead to a potential disability? Thus creating a smaller problem, rather than an actual solution.

These painkillers can eliminate the problems of tomorrow that we know will occur, but haven’t yet.

For example, battery safety as we need to pack higher capacities into ever-smaller battery sizes. Remember Samsung’s re-call of their smartphones in 2016? While re-calling high-end smartphones can sound like a small issue, these battery problems will be magnified 1000-fold when they occur in our electric vehicles while driving or when we live in solar powered homes backed-up with battery storage.

Breakthrough innovation behind your solution is key!

“Risk-taking is the essence of innovation”

(Herman Kahn, Futurist & Founder of the Hudson Institute)

Warren Buffet has famously said that when investing, he looks for business moats that allow businesses to maintain competitive advantages over their competitors. Similar principles apply with EIC Accelerator funding. Instead of a formidable market position, the accelerator looks for radical breakthrough innovation & technology, making them the highest risk bearing investor in the EU.

Unfortunately, if your innovation is not world altering and depends almost uniquely on rapid market entry and uptake, the instrument might not be for you.

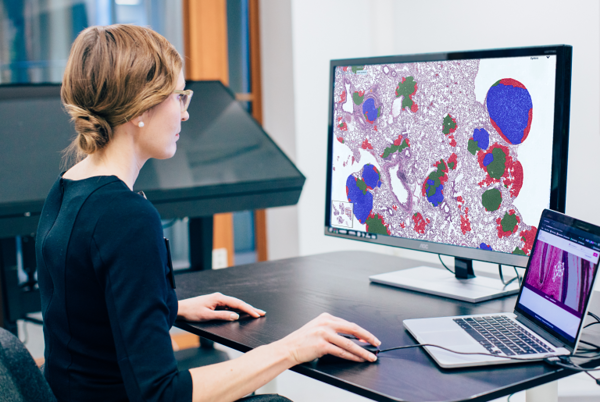

But, when a startup is making a difference, is led by a connected team and is facing a risky uphill battle to bring their disruptive innovation to the market, EIC’s eyes light up as the company has the high risk-reward ratio to potentially become a EIC Accelerator champion. This makes it the perfect funding instrument for deeptech, medtech, university spin-offs and market creating innovation.

Have you really tried to raise funds from the market?

“The only way you are going to have success is to have lots of failures first.”

(Sergey Brin, Google)

Fundraising is hard for startups, especially ones with market creating potential, never seen before technology or heavily patented hardware solutions.

You know… the types that change the world.

We know that, contrary to popular belief, that raising a round is easier when the solution is easy to grasp by investors. This is why analogues like “we are like Facebook, but for people with dogs” are popular.

But these statements are not always evident or possible when it comes to breakthrough innovation. This leads to a lot of rejection. Depending on the solution, market popularity and investor availability it can take 100s of NO-s before a yes.

It can take 300 NO-s before a yes, like when Pandora the music streaming platform was looking for capital.

It can take 243 NO-s before a yes, like when Howard Schulz was reforming Starbucks to be a global coffee-on-the-go brand.

When it comes to deeptech, finding a suitable investor to pitch is even harder… but in reality… having done less than 50 pitches is not really even trying.

If you have raised your seed or A-round funds, gotten your 50+ NO-s, and are now facing a dilemma that you require follow-up investments (€5M-€17.5M). Then, you have reached the perfect time for EIC Accelerator. Because you have really tried, pivoted and adapted your approach.

Do you have a clear value proposal & unique selling point?

It’s better to make a few people really happy than to make a lot of people semi-happy

(Paul Graham, Co-Founder of Y Combinator)

We in Invent Baltics have a simple rule that majority of investors follow. If you say that you do 10 things better, you are more than likely to do nothing better that actually matters. This logic applies with target markets as well. Simply, it is better to concentrate on one opportunity at a time and shape your value and strategy accordingly and pivot when necessary.

The most profitable companies in the world do a lot of things, but most of the time, we know them for a single thing. Apple with consumer electronics (you know… iPhones…), Alphabet with advertising (Google search engine) and Estonia’s own Bolt with fast & affordable rides (ride sharing platform).

All of these companies have several business lines in practice, and they can list more than 10 things they do better than their competitors. The key difference here is… that they don’t.

These companies know that having a singular focus when it comes to their value proposal or unique selling point is better than having 10 weak ones. So, should YOU!

Therefore, when listing aspects that you do better, be critical and ask yourself how much do the points listed actually matter:

- Are they there to make you feel better?

- Or are they really bringing value to your target customer, beyond simply being nice to have?

Is your high risk-reward business scalable AND sustainable?

“We cannot choose between growth and sustainability – we must have both.”

(Paul Polman, Unilever)

One of the key aspects of any startup is the ability to scale their service, product, vision rapidly and cost-effectively. This is especially important for high risk-reward companies as when the product is ready and a lot of money has been spent, it needs to make profits for investors and in order to keep the company running. It is simple, if you cannot scale, you will not survive!

However, while making profits is vital, it is no longer enough on its own!

In the world of impact investment aimed at making the world a better place, every startup faces the question: “Are you leaving the world a better place, while growing your business?”

It is no longer enough to:

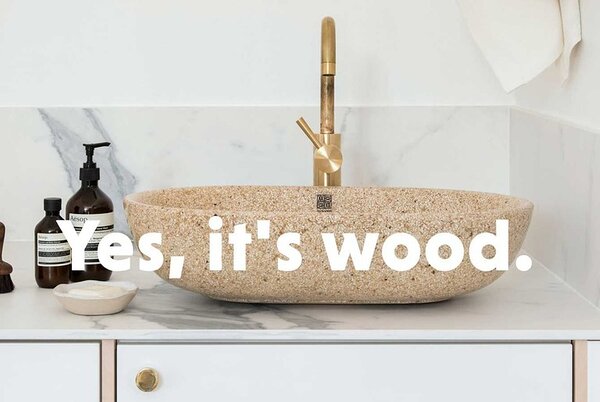

- Drastically reduce textile’s climate impact through completely recyclable textile

- Eliminate disabilities when treating bone voids,

- Fight depression daily through daily brain stimulation

When tackling these pains, companies must be aware – like investors are – that new problems do not arise from the solutions that treat the pain.

Thus, growth companies are faced with a unique perspective that was not so important just 10-years ago when it comes to becoming a EIC Accelerator Champion.

The company needs to solve a real pain, scale to become profitable, while not causing additional harm to the world we live in today.

Let’s try to make sense of all of this…

“The only strategy that is guaranteed to fail is not taking risks.”

(Mark Zuckerberg, Facebook)

While these 6 key factors can seem daunting to startups looking to raise funds today, clearing these does come with a clear benefit in EIC Accelerator funds that consist of a grant (€0.5M-€2.5M) to develop, test and fully validate your breakthrough innovation.

Furthermore, it offers long perspective capital (up to €15M in equity) with a maximum of 15 years (patient capital) from the designated EIC equity fund to ensure that the breakthrough innovation will reach key markets.

Simply put, EIC Accelerator can be your best bet in securing funds for high risk-reward technology in the EU today.

When reading about the 6 key factors, did you feel like you were reading about your company?

Then reach out to us!

P.S. If you were wondering about the examples presented above…

Yes, they are direct examples from our library of EIC Accelerator Champions from the last 2 years.

← Back to press releases

_block.jpg)